Let’s assume, Berkshire Hathaway, a publicly traded company in the US, has 1,000,000 outstanding shares. The current market price of each share is $10, making the company’s total market capitalization $10,000,000. After that, the par value of shares plus the original share issue amount obtained from investors gets ignored. When shares are repurchased, they may either be canceled or held for reissue. Technically, a repurchased share is a company’s own share that has been bought back after having been issued and fully paid. Treasury stock are shares that a company has repurchased from the open market or from shareholders.

Treasury stock vs. common stock

However, this rise, driven by the buyback, is usually short-lived and may not be sustainable in the long run. The stock may eventually decline if the company’s operational performance doesn’t improve or earnings cannot support the increased stock price.Investors should be cautious in this situation. While a buyback may temporarily boost the stock price, how to start a freelance bookkeeping and payroll service only improvements in financial performance and business fundamentals can genuinely support sustained stock growth. Otherwise, once market enthusiasm fades, the stock price could return to levels that reflect the company’s actual performance—or even drop below the pre-buyback level—rendering the short-term “buyback effect” a fleeting phenomenon.

What is your current financial priority?

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

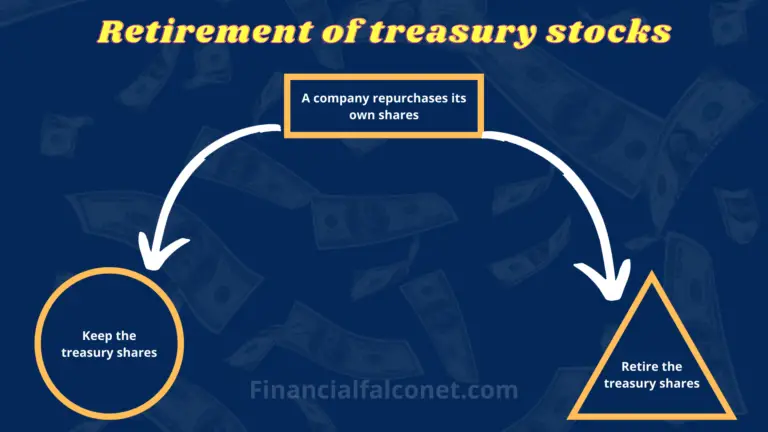

Accounting for the Retirement of Treasury Stock

This reduces the number of shares outstanding, and assuming the company doesn’t overpay for their shares, this can help bolster shareholder returns. Be sure to see if the shares have the word “canceled” imprinted on them, often with holes punched through the certificate. If so, the share is worthless, but it might be worth something to a collector. For a fee, stock search companies will do all of the investigation work for you and, if the certificate ends up having no trading value, they may offer to purchase it for a collector’s value. According to Article 28-2 of the Securities and Exchange Act, when a company repurchases treasury shares, it must transfer them to its employees within five years of repurchasing. If the shares are not transferred within five years, they are considered unissued and subject to change registration.

If no stated or unstated consideration in addition to the capital stock can be identified, the entire purchase price shall be accounted for as the cost of treasury shares. Retired stocks or retired shares are usually stocks that have been retired from the market and can no longer be traded on the open market. There are many reasons why a company may buy back its shares but one of the key reasons may be to increase the value of the shareholders’ equity.

- When a company buys back its own shares, such shares are classified as treasury stock.

- Additionally, if management eventually decides to retire the treasury stock, the amount is no longer considered issued, either.

- If there had not been a credit balance in this account, the difference would have been debited to Retained Earnings.

- A corporation’s board of directors may decide to acquire treasury shares for various reasons.

- Alternatively, it can decide not to reissue the shares held in treasury, and retire the stock.

All it does is removing all items that are related to the retired stock from the balance sheet. Of course, the number of outstanding shares on the market will be reduced as a result of retiring the treasury stock. Acquisition of a company’s own stock is an equity transaction that results in no gain or loss on the company’s books, regardless of the price paid for the stock. The transaction results in a contra-equity item that is reported as a debit against stockholder equity. Treasury shares do not earn dividends and do not provide the company with additional votes at the annual stockholders’ meeting. Treasury stock can be made available for employee incentive plans or reissued for sale to the public, whereas retired shares are canceled and cannot be used for any purpose.

Companies may do this to create some financial flexibility since treasury shares can always be sold to raise cash if needed. Or, enough stock in the company’s treasury can ensure nobody else will amass a controlling stake. On the other hand, if the cost of buying treasury stock is less than the amount that the company received when it was issued, the company needs to credit the difference into the paid-in capital from the retirement of stock instead. Redeemable stock (virtually always preferred shares) gives the owner the right to sell the shares to the corporation according to a prearranged schedule of prices and times. This arrangement tends to reduce the investor’s risk of a decreased market value.Some companies have issued mandatory redeemable stock, which must be turned into the company by a specific date.

However, the retirement of shares was purely a fictional element designed to add suspense and increase interest among investors. Suppose company Z repurchased shares at $4 per share, amounting to one lac dollars. The simplest and most widely-used method for accounting for the repurchase of stock is the cost method. Thus, one way the corporation can avoid dividend restrictions is to purchase treasury stock.